Singapore ranked second in world for foodtech startups in new report

Reading Time: 3 minutesSingapore is an increasingly big player in the foodtech industry, ranking second placed globally in a new report by StartupBlink. A branch of food science, foodtech focuses on production, preservation and research and development, ensuring product security, safety and quality standards.

The city state’s position behind only the US underscores Singapore’s commitment to supporting foodtech startups and advancing sustainable food production technologies, providing them with infrastructure, funding and opportunities to collaborate.

“Singapore (2nd) and Spain (6th) are key overperformers among the top 10 countries, ranking 3 and 9 spots higher than their general startup ecosystem rankings, respectively,” the startup researcher writes. The city-state is “three places higher than its general startup ecosystem ranking… more than double that of the UK, even though the UK ranks higher in the overall startup ecosystem rankings,” StartupBlink adds.

State backing sees Singapore overtake UK, Germany

StartupBlink’s report notes that Singapore has outperformed traditional foodtech startup leaders such as the UK and Germany. This success is largely credited to aggressive state-backed initiatives such as FoodInnovate, which provides infrastructure and funding support. However, critics argue that the ecosystem is overly reliant on government support, raising concerns about long-term viability once state incentives cease.

“In addition, FoodInnovate organizes challenges like Asia’s Great Snack Challenge and the Meatless Meat Challenge, creating opportunities for collaboration with established brands to develop innovative snack products and alternative meat options,” StartupBlink writes.

A key driver has been Singapore’s investment in state-backed research and development. Government agencies such as the Singapore Food Agency (SFA) and the Agency for Science, Technology and Research (ASTAR) provide grants and regulatory support to startups. These expedite authorisations of new food technologies, including lab-grown meat and plant-based alternatives. Initiatives by ASTAR have facilitated the rapid scaling of operations for global food-tech innovators, including Corning Life Sciences and ScaleUp Bio.

Private firms collaborate with research units

Singapore has actively fostered collaboration between private companies, research institutions, and international investors. Nurasa, a sustainable food innovation platform owned by Temasek, inaugurated the Food Tech Innovation Centre (FTIC) in Singapore. Operational since 2023 and located within Biopolis, the 3,840sqm facility offers advanced laboratories equipped for plant protein extrusion and precision fermentation.

These resources aim to assist alternative protein companies in scaling up production and accelerating market entry. The FTIC also houses the NuFood Concept Studio open innovation platform, which focuses on developing consumer-centric sustainable foods.

Collaborations include partnerships with businesses including ScaleUp Bio and Cremer Sustainable Foods, who can access advanced food processing equipment and mentorship programmes.

Singapore aims for 30% self-sufficiency by 2030

Another initiative is the 30 by 30 strategy, which aims to meet 30% of Singapore’s nutritional needs locally by 2030, aided by increased funding for agritech innovations, vertical farming, and sustainable food production methods. Programmes such as the Agri-Food Cluster Transformation Fund incentivise companies to adopt advanced technologies that improve food resilience and security.

Questions remain about the sustainability of its growth due to its dependence on government intervention. The city-state has positioned itself at the forefront of alternative proteins and sustainable food solutions, although many such startups have struggled to scale globally due to limited market size and regulatory challenges abroad.

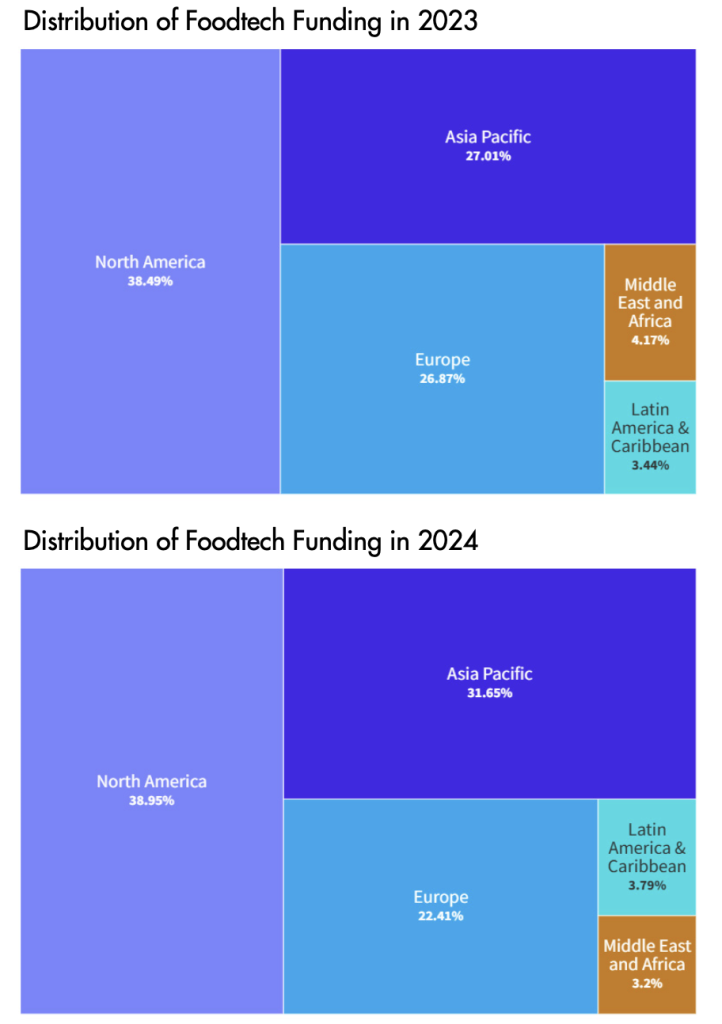

Nevertheless, despite a sharp 71.6% decline in global foodtech funding in 2024, Singapore continues to attract investment. In 2024, Asia Pacific saw the most significant increase in Foodtech funding, rising from 27.01% to 31.65%. The coming years will reveal whether Singapore can sustain its leadership or face stagnation once external funding pressures intensify.

The US maintains its leadership in foodtech, with a score 1.4 times higher than Singapore, StartupBlink writes, adding that “the smaller score gap in foodtech rankings compared to general startup ecosystem rankings highlights Singapore’s significance in the industry”.