ASEAN governments urged to close policy gaps as startup ecosystems stall

Southeast Asia’s startup ecosystems are losing visibility in global rankings as regional funding contracts and policy fragmentation persist, according to a new report released on 25 June.

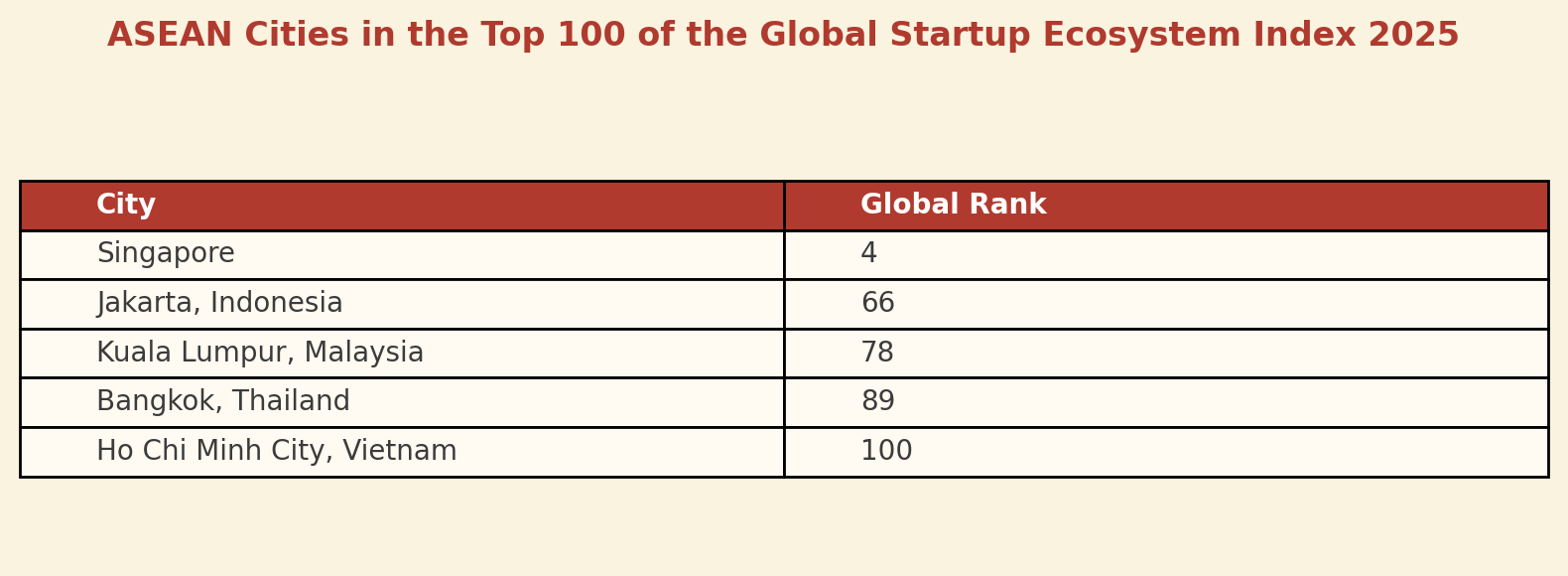

Singapore dropped from 2nd to 4th place in the latest, annual StartupBlink Global Startup Ecosystem Index, which evaluates more than 1,400 cities and 100 countries based on startup quantity, quality and business environment.

ASEAN's uneven performance reflects structural problems, including talent constraints, uncoordinated capital flows and a lack of cross-border regulatory support. ASEAN still lacks a regional capital passport, unified startup visa and shared data framework; structural gaps that continue to limit integration across member states.

Singapore comprises 60% of ASEAN's VC volume

Singapore remained the top-ranked ASEAN ecosystem, according to StartupBlink, accounting for nearly 60% of the region’s venture capital deal volume, according to regional data. However, its relative decline highlights shifting investor attention and intensifying global competition.

“Singapore’s concentration of corporates, talent, and capital is key to enabling startups to thrive and scale," Innovation, Enterprise Singapore Assistant Managing

Director Emily Liew told StartupBlink. "We remain committed to cultivating a robust startup ecosystem and building upon our deep tech foundations to enable startups to anchor and grow from Singapore,” she added.

Other ASEAN capitals lagged behind. Jakarta, Indonesia, and Kuala Lumpur, Malaysia, both slipped slightly, ranking 66th and 78th, respectively. Bangkok, Thailand, held at 89th. Meanwhile, Ho Chi Minh City, south Vietnam, entered the global top 100 for the first time, rising from 104th to 100th overall. It was also the region’s fastest-rising fintech city, climbing 124 places to 54th.

Despite growing investor interest in Vietnam and Thailand, sentiment remains cautious. A Singapore-based fund manager told TIA on background that there is no regional capital passport, no unified startup visa and no clear data framework. ASEAN is still operating in ten silos.

Region pioneers startup visas

Policy advisors and investors have identified six reforms that could stabilise and grow Southeast Asia’s startup landscape. Singapore’s Tech.Pass offers two-year permits for senior tech executives but is limited to national scope. Indonesia’s five-year digital nomad visa, introduced in 2023, targets freelancers rather than company founders. A region-wide startup talent pass would reduce barriers to hiring and founder relocation.

Singapore’s gov’t has committed over SGD 1bn to domestic startups via schemes such as SG Equity. Vietnam, the Philippines and others lack equivalent vehicles. A regionally backed co-investment fund could spread early-stage capital more evenly.

Mixed engagement with regional regulatory sandbox

Singapore’s fintech sandbox helped more than 70 companies pilot services. In contrast, other ASEAN members operate fragmented or underutilised frameworks. A common sandbox protocol would lower compliance costs and encourage regional scaling.

Malaysia Digital’s partnership with Startup Genome provides clear benchmarking. Most other ASEAN members lack unified metrics on exits, employment, or founder flows. ASEAN could adopt a shared reporting standard backed by the Asian Development Bank or UNESCAP.

Thailand’s Eastern Economic Corridor of Innovation has linked biotech and greentech startups with industrial zones. Elsewhere, special economic zones often exclude startup support. Integrating startup policy into logistics and industrial corridors would enable scale.

Vietnam has launched an AI strategy focused on national priorities. Global firms continue to prefer Singapore for sandbox trials. ASEAN should jointly position itself as a neutral and open testbed for AI, greentech and public-good technology.

Startup funding across the region fell to USD 4.56bn in 2024, down 42% year-on-year, according to a separate report by DealStreetAsia. Late-stage deal value declined 64%, and the final quarter of 2024 marked the lowest funding total in 6 years, the regional financial news and intelligence platform added.